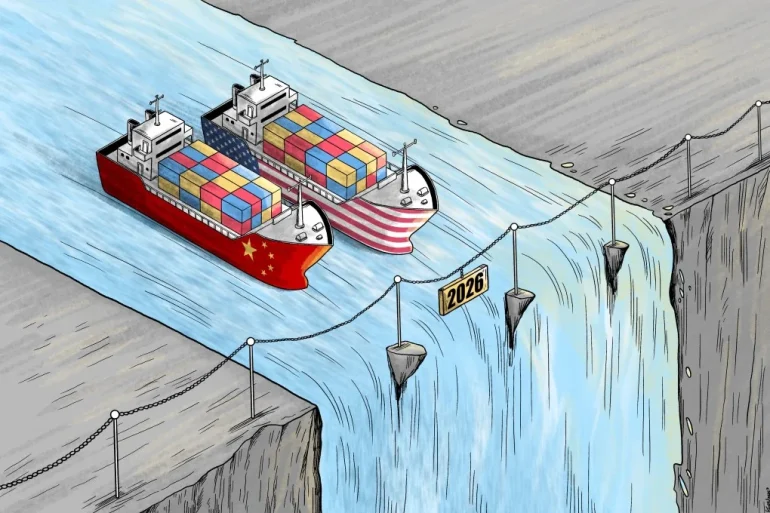

As 2025 draws to a close, the fragile truce in U.S.-China economic relations, brokered by President Donald Trump and Chinese leader Xi Jinping in October, appears increasingly vulnerable. Lawmakers from both parties on Capitol Hill are sounding alarms, predicting a resurgence of conflicts over trade, Taiwan, and supply chains that could unravel the current pause in hostilities. Based on interviews with more than two dozen members of Congress, including those on key committees like the House Select Committee on China and the Senate Foreign Relations Committee, experts foresee turbulence ahead. Despite a temporary easing of tariffs and export restrictions, skepticism runs deep about China’s commitment to its pledges, such as curbing fentanyl precursor chemicals and boosting purchases of American agricultural products.

This pessimism persists even as the White House expresses optimism, highlighting Trump’s rapport with Xi as a foundation for ongoing progress. However, many lawmakers view the truce as a brief intermission in a high-stakes rivalry. As Rep. Greg Stanton (D-Ariz.) put it, it’s like a “heavyweight fight” where both sides are gearing up for the next round. Below, we explore the four key issues that could ignite renewed friction in the coming year.

The Soybean Standoff: A Domestic Pressure Point

One of the most immediate risks stems from China’s apparent reluctance to fulfill its promises on soybean purchases, a move that directly impacts American farmers and could provoke a swift response from the Trump administration. U.S. soybean exports to China, a massive market, were halted in May, threatening livelihoods in key farming states like Illinois, Iowa, and Nebraska—regions crucial for Republican electoral success in the 2026 midterms.

In the October agreement, Xi reportedly committed to buying 12 million metric tons of U.S. soybeans by the end of December, with the deadline later extended to February 28. Yet, recent reports indicate Beijing has only acquired a small portion of that amount. This foot-dragging is seen as a “soybean spoiler” that exploits U.S. vulnerabilities without resorting to tariffs. Rep. Jill Tokuda (D-Hawaii) noted that such actions hit close to home, hurting farmers and consumers, and could trigger volatility in bilateral ties. The White House is closely monitoring compliance, but if the February deadline passes without action, it might prompt retaliatory measures, shattering the truce.

The Taiwan Tinderbox: Escalating Military Threats

Beyond trade, Taiwan remains a volatile flashpoint, with China’s intensifying preparations for potential invasion posing a direct challenge to regional stability. Although the issue has not been central in recent U.S.-China talks, Beijing’s actions this year—including the debut of a new military barge system in October to facilitate beach landings—signal heightened aggression.

Tensions are also spilling into neighboring areas, such as the East China Sea, where Chinese jets recently locked radar on Japanese aircraft, a provocative step short of actual combat. Lawmakers like Rep. Ro Khanna (D-Calif.), who visited China with a bipartisan delegation, warn that Beijing is “tightening the noose” around Taiwan. Rep. Seth Moulton (D-Mass.) added that if China oversteps in antagonizing U.S. allies like Japan and Australia, it could make sustaining the truce impossible.

The U.S. maintains its policy of “strategic ambiguity” regarding a response to Chinese aggression, a stance Trump has upheld by saying the world would “find out if it happens.” With a planned Trump-Xi summit in Beijing in April, any escalation could derail diplomatic efforts and reignite broader confrontations.

Looming Export Restrictions: Chokeholds on Critical Supplies

Another potential fracture involves China’s control over essential resources, where Beijing could reimpose export bans as leverage. Lawmakers are particularly concerned about rare earth minerals—vital for electronics, defense, and renewable energy—which China dominates globally. Although restrictions were eased earlier this month, with Beijing promising “timely approval” for exports, ten interviewed lawmakers suspect a reversal is imminent.

Even more alarming is the possibility of extending controls to pharmaceuticals, where China supplies 80 percent of U.S. active pharmaceutical ingredients for everyday drugs like aspirin and blood pressure medications. Rep. Nathaniel Moran (R-Texas) highlighted the risk: “Overnight, China could turn off the spigot,” disrupting American healthcare. The U.S.-China Economic and Security Review Commission has urged reducing this dependency, but any new restrictions could expose vulnerabilities and prompt U.S. countermeasures, further straining relations.

China’s Expanding Military Might: A Challenge to U.S. Dominance

Finally, China’s rapid military modernization threatens to undermine the truce by asserting dominance in the Indo-Pacific. With over 200 warships, Beijing now boasts the world’s largest navy, bolstered by the recent commissioning of its third aircraft carrier, the Fujian. Equipped with advanced electromagnetic catapults for launching fighter jets, the Fujian rivals U.S. carriers like the USS Gerald R. Ford in capability, if not size.

This buildup is viewed as incompatible with stable U.S.-China ties. Defense Secretary Pete Hegseth has emphasized protecting allies from Chinese aggression amid this “historic military buildup.” Five lawmakers echoed concerns that Beijing’s aggressive posture—aimed at economic, diplomatic, and military global dominance—positions the U.S. as a direct adversary. As Rep. Moran stated, China’s long-term goals clash with American interests, making sustained peace elusive.

In summary, while the October truce has provided a momentary reprieve, the underlying issues—ranging from unmet trade commitments to military posturing—suggest 2026 could see a return to confrontation. Lawmakers across the aisle urge vigilance, warning that without genuine compliance from Beijing, the U.S.-China relationship risks fracturing anew. As the new Congress convenes in January, these tensions will likely dominate the agenda, shaping the geopolitical landscape for years to come.